The Ultimate Guide : How to Selling Gold with Uniprecious 2025

Gold is a timeless asset that has been treasured for centuries. Whether you’re looking to sell gold for financial reasons or simply to cash in on a valuable asset, understanding the process is essential. At Uniprecious, we provide comprehensive guidance to help you navigate the sale of your gold with confidence, ensuring that you get the best value for your precious metals.

Why Sell Gold?

There are many reasons why individuals or businesses may choose to sell gold. Some of the most common reasons include:

- Financial Need: Whether it’s for an unexpected expense or to fund a new investment, selling gold can provide quick access to cash.

- Market Conditions: When gold prices are high, it may be an excellent time to sell your gold and take advantage of market conditions.

- Downsizing or Decluttering: Sometimes, people simply sell gold items they no longer need, such as old jewelry, coins, or bullion, as part of downsizing or decluttering.

- Portfolio Rebalancing: Investors may sell gold as part of portfolio diversification, or to switch to other assets that offer higher potential returns.

Types of Gold You Can Sell

Before selling your gold, it’s important to understand the different types of gold that are commonly sold:

- Gold Jewelry: Jewelry is one of the most common forms of gold sold. However, the value of gold jewelry is not solely determined by its weight. Other factors such as the craftsmanship, design, and any gemstones it may contain can influence its value.

- Gold Bullion: Gold bullion refers to gold bars or coins that are primarily bought and sold for investment purposes. Bullion typically has a high purity (usually 99.9% or higher) and is sold based on its weight and the current market price of gold.

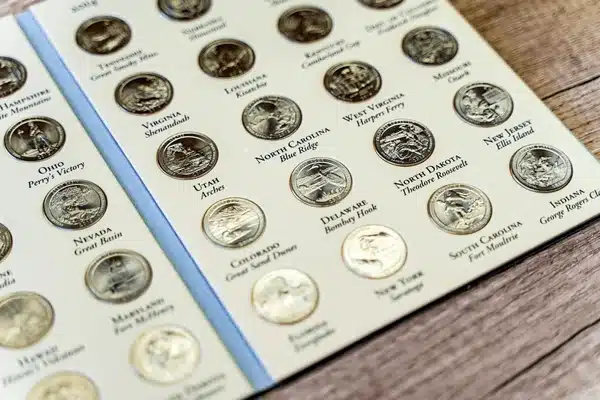

- Gold Coins: Collectible gold coins, such as American Gold Eagles, Canadian Gold Maple Leafs, or South African Krugerrands, can often command a premium over the market price of gold due to their rarity and collectible value.

- Gold Scrap: If you have old or broken jewelry, scrap gold can also be sold. Scrap gold is typically melted down and sold based on its gold content.

Steps to Selling Gold

Selling gold may seem like a simple process, but there are several important steps to follow to ensure that you get the best price for your items.

- Know the Current Market Price of Gold: Before selling your gold, it’s essential to check the current price of gold. Gold prices fluctuate daily based on global market conditions, so staying informed will give you a better understanding of what to expect when you sell.At Uniprecious, we keep our clients updated with real-time market data, ensuring you’re always informed about the latest price trends.

- Determine the Value of Your Gold: The value of your gold is determined by several factors:

- Purity: Gold is usually measured in karats (K), with pure gold being 24K. The higher the karat, the more valuable the gold.

- Weight: The weight of your gold items is critical in determining their value. Gold is priced per gram or ounce, so the heavier the item, the more it will be worth.

- Condition: The condition of your gold can affect its resale value. Jewelry in good condition will fetch a higher price than broken or damaged items.

- Find a Reputable Gold Buyer: When selling gold, it’s important to choose a trustworthy buyer. At Uniprecious, we pride ourselves on our transparent and ethical approach to buying gold. We offer competitive prices and will assess your gold carefully to ensure that you receive the fair market value.

- Get Multiple Offers: It’s always a good idea to get multiple offers before making a decision. This allows you to compare prices and ensures that you’re getting the best deal. At Uniprecious, we offer free evaluations and will give you an honest, no-pressure offer.

- Complete the Transaction: Once you’ve accepted an offer, the transaction can be completed. If you’re selling physical gold, such as coins or jewelry, payment can typically be made in cash, bank transfer, or cheque. Uniprecious offers fast, secure payment options to make sure you receive your funds quickly and safely.

How to Maximize the Value of Your Gold

To ensure you get the most value for your gold, consider the following tips:

- Know Your Gold’s Purity and Weight: Before selling, make sure you’re aware of the purity and weight of your gold. This will help you get an accurate valuation and avoid underpricing your items.

- Sell When Prices Are High: Timing is crucial when selling gold. Keep an eye on market trends and look for opportune moments to sell when prices are high. Uniprecious offers regular market updates to help you make an informed decision.

- Consider Selling in Bulk: If you have a large amount of gold to sell, you may be able to negotiate a better price when selling in bulk. Larger transactions often come with more favorable terms.

- Sell Directly to a Dealer: Selling gold to a dealer directly, rather than through an intermediary, can sometimes yield a higher price, as dealers often offer more competitive rates.

Why Sell Your Gold with Uniprecious?

At Uniprecious, we make the process of selling gold simple, transparent, and rewarding. Whether you’re selling gold jewelry, coins, or bullion, we offer:

- Competitive Pricing: We always offer competitive rates based on the current market value of gold.

- Expert Evaluation: Our team of experts will provide you with an accurate and honest evaluation of your gold items.

- Fast and Secure Payments: We offer fast and secure payment methods, ensuring that you receive your funds without delay.

- Ethical and Transparent Process: We prioritize transparency and honesty in all our transactions, ensuring you get the best deal without any hidden fees.

Selling your gold with Uniprecious is a straightforward and secure process. Whether you’re liquidating your assets, making room for new investments, or simply cashing in on your gold, we are here to guide you every step of the way.