Silver has been a valuable asset for centuries, offering investors both a store of wealth and a hedge against inflation. At Uniprecious, we recognize the unique position that silver occupies in the precious metals market and are here to provide a comprehensive guide on how to invest in silver, whether you’re new to investing or looking to diversify your portfolio.

Why Invest in Silver?

Silver has long been considered a safe haven during times of economic uncertainty. While gold is often the go-to precious metal for investment, silver has its own distinct advantages:

- Affordability: Silver is generally more affordable than gold, allowing investors to buy more for their money. This makes silver an attractive option for those who want to start investing in precious metals without breaking the bank.

- Diversification: Silver provides an excellent opportunity to diversify your investment portfolio. As a tangible asset, silver can act as a hedge against stock market volatility and inflation.

- High Demand: The demand for silver continues to rise, particularly due to its use in technology, industry, and renewable energy. Silver is widely used in electronics, solar panels, and electric vehicle batteries, making it a valuable industrial metal in addition to being a precious metal.

- Long-Term Growth Potential: Historically, silver has demonstrated substantial growth potential. Although it can be more volatile than gold, many investors see silver as a high-reward investment, especially during times of economic instability.

Types of SilverInvestments

There are several ways to invest in silver, each with its own benefits and risks. Here are the most common options:

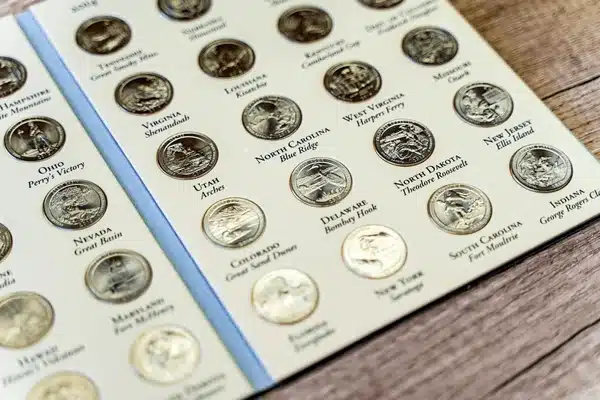

- Silver Bullion Coins and Bars: One of the most popular ways to invest in silver is by purchasing physical silver in the form of bullion coins or bars. At Uniprecious, we offer a wide selection of high-quality silver bullion from trusted mints around the world, including well-known coins like the American Silver Eagle and the Canadian Silver Maple Leaf. Physical silver provides the benefit of tangible ownership, allowing investors to hold the metal in their hands.

- Silver ETFs (Exchange-Traded Funds): If you prefer a more liquid investment, silver ETFs provide an easy way to gain exposure to silver prices without actually owning the physical metal. These funds track the price of silver and trade on major stock exchanges, allowing investors to buy and sell silver in real-time. While silver ETFs are convenient, they don’t provide the same level of security as owning physical silver.

- Silver Mining Stocks: Another indirect way to invest in silver is by purchasing shares in companies that mine silver. This can offer leveraged exposure to silver’s price movements, as mining stocks often outperform the price of the metal itself during periods of rising silver prices. However, investing in mining stocks also comes with additional risks, including the operational and financial performance of the company.

- Silver Futures and Options: For experienced investors, silver futures and options offer a way to speculate on the future price of silver. These contracts allow investors to buy or sell silver at a predetermined price at a future date. However, futures and options trading is complex and carries a higher level of risk, making it less suitable for beginners.

How to Start Investing in Silver

- Set Your Investment Goals: Before investing in silver, it’s important to define your goals. Are you investing for short-term profits, or are you looking to build long-term wealth? Understanding your investment objectives will help you decide which form of silver investment is right for you.

- Choose Your Investment Method: Once you’ve set your goals, it’s time to decide how you want to invest in silver. At Uniprecious, we specialize in offering high-quality physical silver products, such as silver bars, coins, and bullion. If you’re interested in a more hands-off approach, we can also help guide you in exploring silver ETFs or mining stocks.

- Diversify Your Portfolio: While silver can be an excellent investment, it’s important to diversify your portfolio to manage risk. Consider holding a mix of precious metals, including gold, platinum, and silver, along with other asset classes such as stocks and bonds.

- Monitor the Market: The price of silver can fluctuate due to factors like supply and demand, industrial use, and geopolitical events. At Uniprecious, we keep a close eye on the silver market and provide timely updates to help our clients make informed investment decisions. Regularly monitoring the market allows you to capitalize on price movements and adjust your strategy as needed.

Why Invest in Silver with Uniprecious?

At Uniprecious, we make investing in silver simple and secure. We offer a broad range of silver products from trusted mints and ensure that all of our silver is of the highest quality. Our team of experts is dedicated to providing personalized guidance, whether you are a seasoned investor or just getting started.

Investing in silver with Uniprecious offers the following advantages:

- Quality Assurance: We only offer silver products from reputable mints and ensure they are of investment-grade quality.

- Expert Guidance: Our team provides valuable insights and recommendations to help you navigate the silver market.

- Secure Storage Options: We provide secure storage options for your physical silver, ensuring that your investment is kept safe.

- Global Access: Whether you are based in Hong Kong or abroad, Uniprecious offers international access to the best silver investments.

Start your silver investment journey with Uniprecious today and take advantage of this exciting opportunity to diversify your portfolio and build wealth with one of the most sought-after precious metals.